THE EDGE WEEKLY ISSUE#1001

THE WEEK OF FEBRUARY 10 – 16, 2014

THE STATE OF THE NATION

A WEEKLY UPDATE

|

| Are Malaysian households beginning to feel the pinch? |

Last week, we published a

special report entitled “The State of the Nation”. It addressed various issues about the

economy, the stock market and politics today that you need to know.

Using the horse as an

analogy, given that this is the year of the Wooden Horse in the lunar calendar,

The Edge argued that for Malaysia

The horse was

overstretched in the last few years, galloping after being fed financial

steroids. The fiscal indiscipline and

consumption spree of the last few years were facilitated by a massive injection

of cheap global liquidity and an enormous growth in domestic bank loans to

consumers.

The steroids are now

being gradually withdrawn. Liquidity is

moving out of emerging markets and interest rates are set to rise

globally. Chart 1 shows the performance of major world stock

markets since the start of the Year of the Horse. Clearly, the horse is not galloping. Whether this is due to poorer-than-expected

manufacturing data from the US China

The stock markets did not

only fall over the last few trading days, but more significantly, they all saw

single-day plunges.

In the coming months, The

Edge will discuss various issues and attempt to provide insights, analyses

and understanding. In every issue of The

Edge this year, The State of the Nation column will highlight recent

developments by updating and analysing further the charts used in the original

report. This will help you keep track of

the key variables to assist you in making informed business and investment

decisions.

Real interest

rates turn negative

Malaysian households are

grappling with a rise in the cost of living and the effects are beginning to

show, ahead of much bigger price hikes expected this year.

Today, we look at what

the inflation numbers and, incidentally, Public Bank’s latest results tell

us. The worst is yet to come in terms of

rising prices, yet we are already seeing negative real interest rates

and stress emerging in some households.

Negative real interest

rates arose after inflation outpaced deposit rates in Dec 2013. This means inflation is eating the

value of money in the bank.

The headline inflation rate

in December 2013, as measured by the Consumer Price Index (CPI), rose to a more

than two-year high of 3.2% from 2.94% a month earlier and just 1.25% in

December 2012 (see Chart 2). Bank Negara Malaysia

On the other hand, the

average 12-month fixed deposit (FD) interest rate offered by banks has

stagnated at 3.15% since Nov 2012. (BNM)

has kept the overnight policy rate at 3% since May

5 2011 .

Based on the difference between the 12-month FD rate and the

CPI, savers are now being punished with a negative real interest rate of

0.05%. The gap becomes wider if we take

into account savings with shorter tenures.

The average one-month and three-month FD rates are 2.91% and 2.97%

respectively while tiered saving accounts typically yield less than 1%.

As highlighted in Chart 3, positive real

interest rates have been declining over the years. Low interest rates, combined with rising

inflation and a flow of foreign funds into the region, helped asst prices rise

in the past.

Interestingly, inflation

has crept up even before the major price hikes expected this year. A 14.9% average increase in electricity

tariff took effect in January. Housing,

water, electricity, gas and other fuels alone constitute 22.6% of the

total CPI weightage.

A higher electricity cost

will have a cascading effect, raising the cost of virtually all goods and services. As the government rolls back subsidies to

trim the country’s budget deficit, the prices of essential goods and services

are likely to continue rising. Hence,

inflation can only be expected to accelerate.

Will the central bank

then raise interest rates to counter inflation?

The consensus is that

there will be a 25bps to 50 bps rise in interest rates this year. Already, emerging markets have started to

raise rates in response to inflation, capital outflow and currency

concerns. However, local interest rates

are not expected to rise much due to the high level of household and government

debt. That being the case, the trade-off

could be a weaker ringgit.

Household

stress affecting banks?

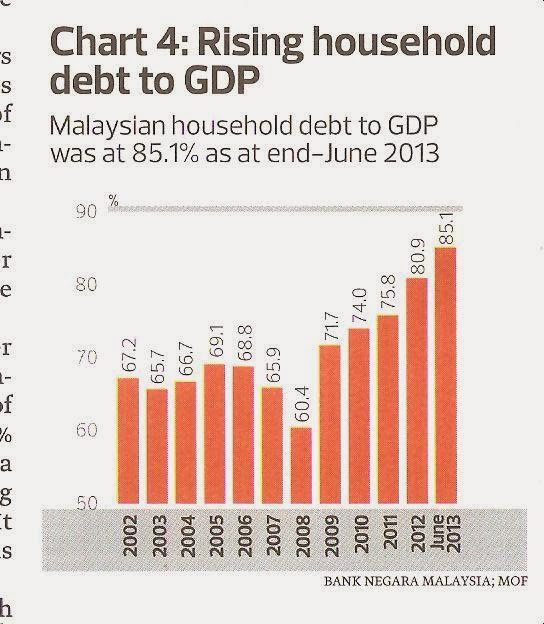

At 85.1%, Malaysia Asia . As households become increasingly squeezed by

high inflation and low wages, their ability to repay loans or borrow money

comes into question. For banks, this

could mean higher non-performing loans and slowing loan growth ahead.

As banks start to

announce their results for 2013, they will no doubt come under scrutiny for

initial signs of household stress. Nonetheless,

any major impact on bank earnings will likely only emerge later in the year or

in 2015 due to the lag in recognising non-performing loans and the disbursement

of previously approved loans.

Public Bank released its

results for 2013 last week, the first bank to do so. Being Malaysia

A quick look at its

earnings shows commendable loan and profit growth in 2013. Its domestic loans grew a robust 12%, gross

impaired loans ratio (the key measure of asset quality) declined to 0.67% from

0.69% while net profit grew 6.2% to RM4.06 billion.

However, it also shows

early signs of stress in the household sector.

Public Bank has very low levels of impaired loans, but the proportion of

its household impaired loans compared with total impaired loans increased over

the past year – from 63.1% to 70.8%.

This was despite its household loans being maintained at 63.8% of total

loans over the last two years.

In 2013, Public Bank’s

impaired household loans grew 21.1% outpacing the 11.8% growth in total

household loans. A quick calculation

shows that the gross impaired loans ratio in its household portfolio increased

from 0.69% in 2012 to 0.74% in 2013 despite an overall decline – from 0.69% to

0.67% -- in total loans.

To be fair, Public Bank’s

impaired loan ratios are very low and should not be a concern to its

shareholders. However, they do imply

that Malaysian households are starting to feel the pinch. E

No comments:

Post a Comment